create a bright future

Strategic Tax Planning

OPTIMIZE YOUR TAX SITUATION

Build Your Financial Safety Net

In making important decisions, it’s smart to get a second opinion. Why not get a second opinion on your financial life expectancy? Duffy Financial Services offers offers a thorough analysis of your business’ tax and financial efficiency. Clients tell us that this one time review of the key areas they should consider pays for itself five times over.

The financial landscape has changed in the last 10 years. Technology claims an ever-growing share of importance in the business world, and tax law changes keep on coming. It’s the perfect time to reassess your goals and operating methods to ensure the greatest probability of success. After our analysis, we’ll make sure you are aware of methods and techniques that could help you achieve your goals faster and with more certainty.

Don't Wait — Get Help NOW! 908.889.4604

Get started on building your “Financial Safety Net” today! Call or Contact Us now!

Key Questions to Consider

Do You Need Strategic Tax Planning?

Could you be saving $10,000 a year on your taxes?

The type of business entity you are running can have a profound effect on your taxes. Reevaluating your business’ entity type could save you thousands of dollars on your tax returns each year!

What would occur to the financial situation of your loved ones if you were taken tomorrow?

We can provide you solutions to ensure your loved ones are financially protected. This could include a life insurance policy, wills, retirement assets, trusts, and powers of attorney, both medical and financial.

Are you struggling to finance your children’s education?

There are a number of strategies to help pay for college depending on time, your money, and other people’s money. Duffy Financial Services advisors can help you choose and set up the best solutions for you.

Are you using all the government programs that the pandemic has made available to you?

Because of COVID-19, the government has made more money available for you through utilizing PPP (Payroll Protection Program), Small Business Association Economic Injury Disaster Loan, payroll tax credits, and state and county based Covid-19 grants.

Are you saving enough for retirement?

Duffy Financial Services can help plan and establish various methods of tax efficiency, allowing more savings for retirement within your business and personally. Each business and individual is different. We’ll take into account your current scene and where you want to be, and customize the optimum solution. Your assets and investments should be in line with the risk you are taking.

Do you feel disorganized when keeping track of your business’ finances?

In a changing landscape shifting solely to digital and cloud-based soluitons, we can help you integrate and utilize bookkeeping and payroll systems that will help optimize productivity. Additionaly, we can help you navigate unknown and complex employee benefits and their compliance implications.

How confident are you in your ability to be up and running if your in-office computer system suddenly failed?

We can conduct a review of your computer systems, backups, policies, procedures, data, and network. Are you protected if your office were to flood, or a crypto virus were to infiltrate your system? How secure is your system, internally and externally? Answers to these questions can have a profound effect on your bottom line.

Secure your future

Proactive Financial Planning

Bright futures don’t just happen — they are created. Many mistakenly believe they don’t or will never have the resources to make their dreams a reality, but at Duffy Financial Services, we know that it simply takes effective planning. We specialize in:

- Integrating business and personal taxes to save money

- Business entity structuring

- Business tax strategy

- Retirement plans, Succession plans

- Wills

- Life insurance

- Powers of attorney – medical and financial

- Personal financial planning and tax strategy

FINANCIAL SECURITY & READINESS QUIZ

Are You Prepared Financially for LIFE?

Ask yourself the questions below and find out if your financial security is healthy enough for life’s ups and downs. If direction is needed, Duffy Financial Services is here to help you get on track.

Are you financially prepared for the unexpected, like a pandemic or the 9/11 attacks?

If the main breadwinner of the family were suddenly not able to ?

Is there a will? What does a deceased’s will say should happen financially?

What is the best way for Insurance money to be allocated?

How will you pay for your children’s college?

How will you pay for your children’s weddings?

If household income were to suddenly change due to death or disaster, can you afford to stay in this house/town?

How will you manage a deceased’s business? Is there a buy/sell agreement in place?

What about widow/widower retirement? How do you best manage 401ks?

Is there a trust under a deceased’s will? Should there be a trust?

Will childcare funds be an issue with only one source if a breadwinner passes away?

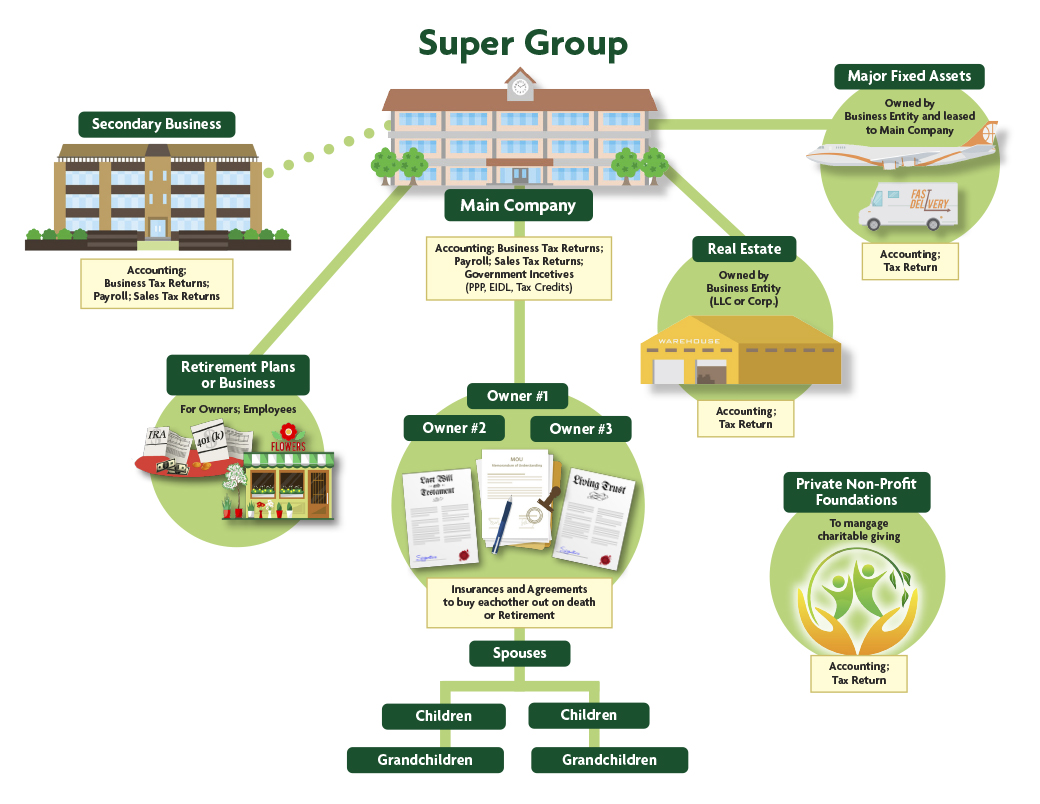

THE “SUPER GROUP” CONCEPT

A 360° View of Your Financial Future

At Duffy Financial Services, we foster what we’ve coined as “Super Groups.” A Super Group is a client who owns their own business, owns real estate and other assets relating to their business, possibly owns a second business, and wants to take care of their family financially. Duffy Financial Services can help create a system that benefits both the individuals and their business as effectively as possible. As a client, Duffy Financial Services will ensure that you have your personal financial interests accounted for whether that be wills, trusts, private nonprofit foundations, or religious groups. The infographic below demonstrates how a Super Group is comprised.

Let's Talk About Your Future

Fill out our Contact Form or call today to schedule a consultation with one of our tax pros.